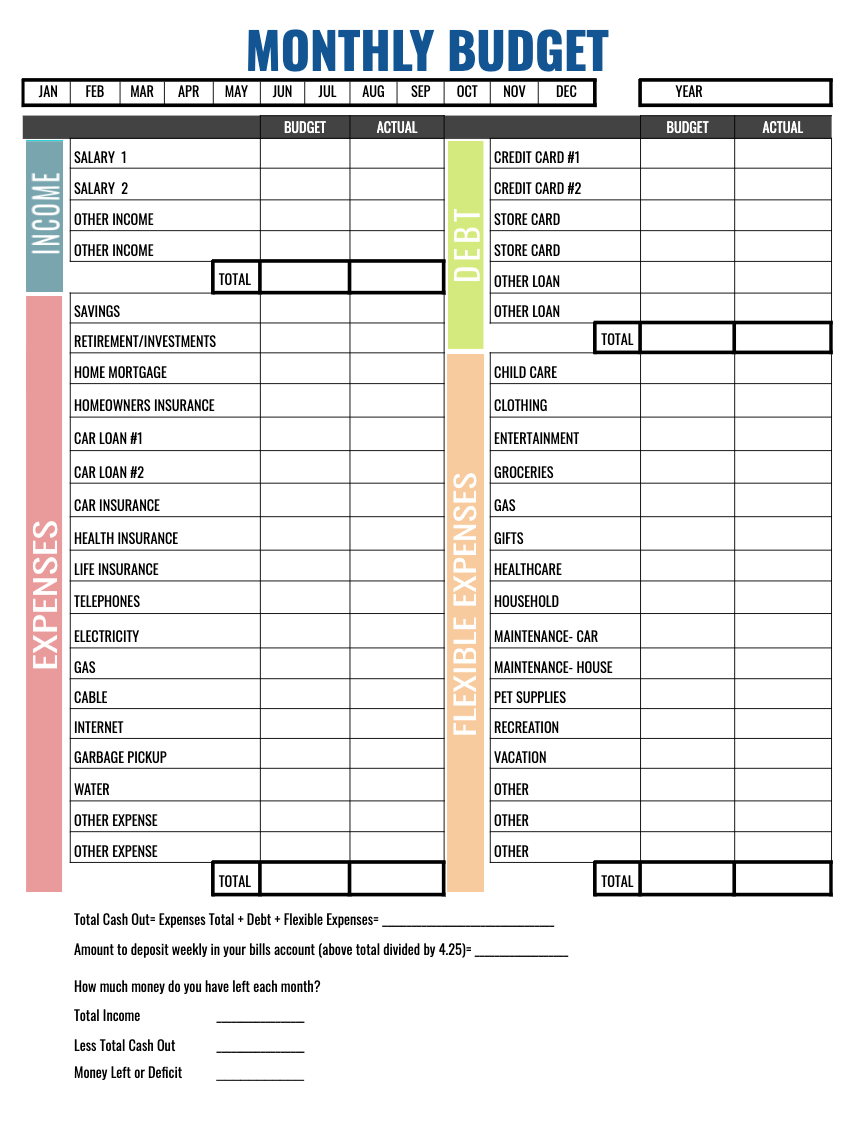

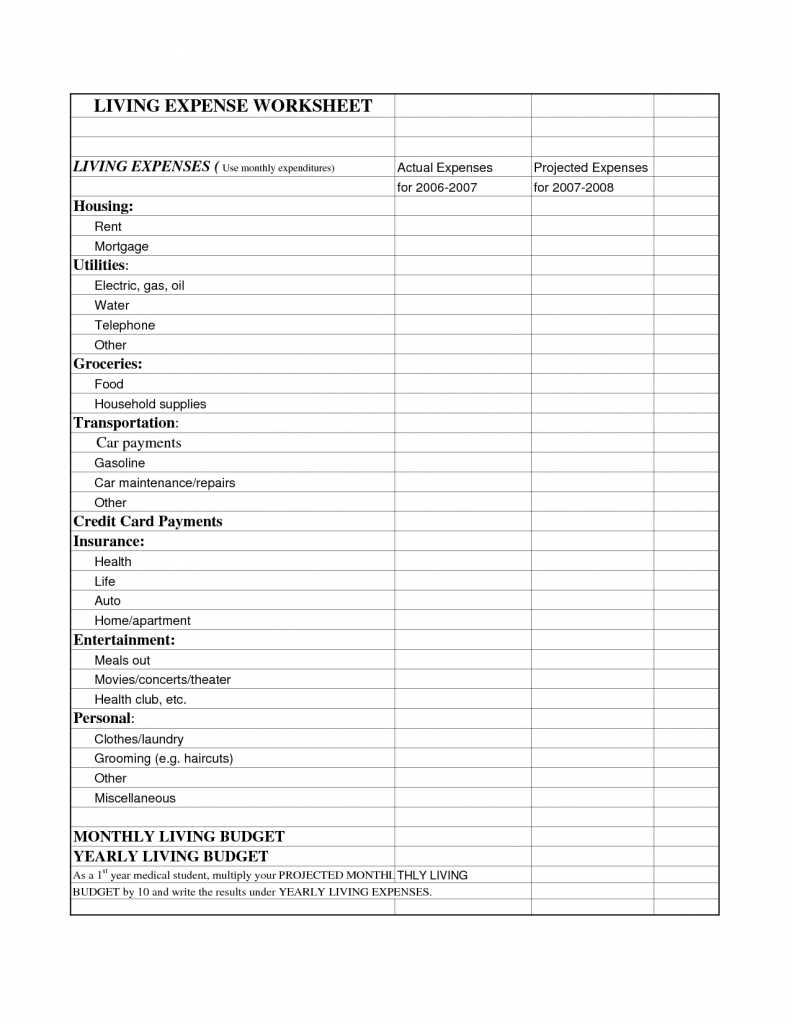

If you know you have one-time spends on the horizon (for example, an upcoming business course or a new laptop), adding them to your budget can help you set aside the financial resources necessary to cover those expenses-and protect your business from a sudden or large financial burden. Just don’t forget to factor those expenses into your budget as well. But there are also costs that will happen far less frequently. Many of your business expenses will be regular expenses that you pay for each month, whether they’re fixed or variable costs. Over time, you’ll get a sense of how these expenses fluctuate with your business performance or during certain months, which can help you make more accurate financial projections and budget accordingly. But when your profits are lower than expected, consider cutting these variable costs until you can get your profits up.Īt the end of each month, tally your variable expenses. When your profits are higher than expected, you can spend more on the variables that will help your business scale faster. Variable expenses will, by definition, change from month to month. These can include things like usage-based utilities (like electricity or gas), shipping costs, sales commissions, or travel costs. Variable costs don’t come with a fixed price tag-and will vary each month based on your business performance and activity.

Examples of monthly expenses software#

Step 1: Tally Your Income Sourcesįirst things first.

Examples of monthly expenses how to#

Now that you understand why business budget creation is so important, let’s jump into how to do it. If you’re planning to apply for a business loan or raise funding from investors, you’ll need to provide a detailed budget that outlines your income and expenses. Your business budget can help you identify areas to decrease your spending or increase your revenue, which will increase your profitability in the process.

In many ways, your business budget is like a financial road map. Because your budget will play a key role in making sound financial decisions for your business, it should be one of the first tasks you tackle.Īnd, as a financially savvy business owner, you’ll also want to have a budget in place to help you:

It outlines key information on both the current state of your finances (including income and expenses) and your long-term financial goals. What’s a Business Budget-and Why Is It Important?īefore we jump into how to create a business budget, let’s quickly cover what a business budget is-and why it’s so important for your small business.Ī business budget is an overview of your business’ finances. What’s a Business Budget-and Why Is It Important?.

0 kommentar(er)

0 kommentar(er)